Tokyo Gas Expands Footprint in US Shale Market with $525 Million Chevron Acquisition

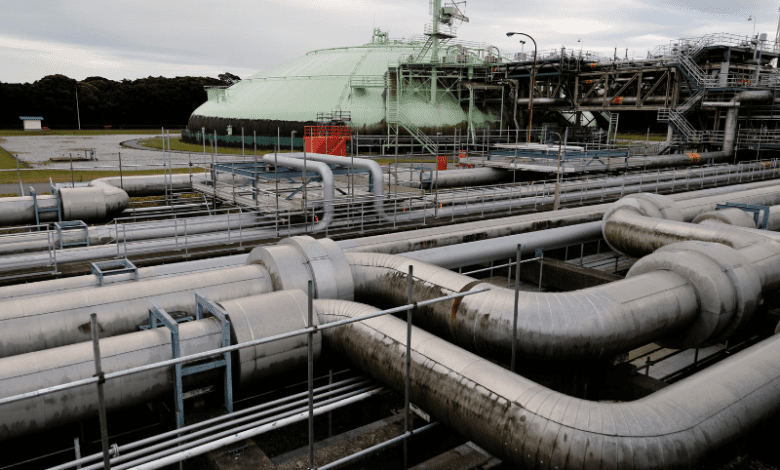

Tokyo Gas is taking major steps towards increasing its foothold in the U.S. shale gas sector with its purchase of a 70% interest in Chevron’s East Texas gas assets for $525 million. The transaction announced on Tuesday is a strategic initiative of TG Natural Resources LLC (TGNR), a joint entity between Tokyo Gas and Castleton Commodities International (CCI). The buyout is strategic to Tokyo Gas’s long term goal of advancing its U.S. gas operations and securing the energy by pumping up LNG shipments from the United States to Japan.

The Haynesville shale in east Texas and northwest Louisiana offers an ideal location for the export of liquefied natural gas (LNG) due to proximity to the Gulf Coast LNG terminals. The investment will create synergies of more than $170 million during the development of the asset, TGNR CEO Craig Jarchow said. Tokyo Gas plans to produce 1.4 billion cubic feet of gas per day by 2030 with future potential exports to Japan.

Though Tokyo Gas claimed that the investment had been on the table long before President Trump’s regime, the action will likely be welcomed by the U.S. government which aims to increase natural gas exports. Through its purchase of Chevron assets, Tokyo Gas is setting itself up to take advantage of the increasing demand for U.S. shale gas.